How to file UAE VAT returns?

Filing UAE VAT returns is very simple, you can do it on your own. Just follow the below steps to automatically generate your VAT form and file it on the FTA portal.

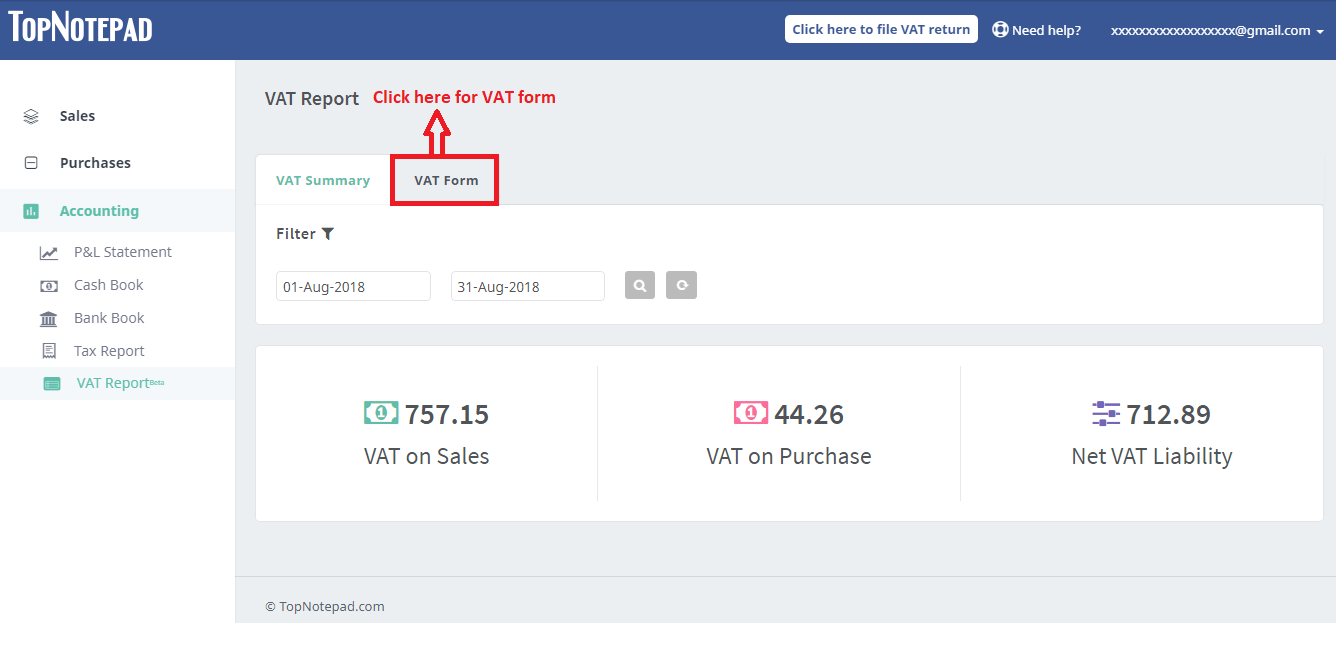

Step 1: Go to the accounting module by clicking on the “Accounting” option available on the left hand navigation. Now, click on VAT report and select VAT form as shown in the screenshot below.

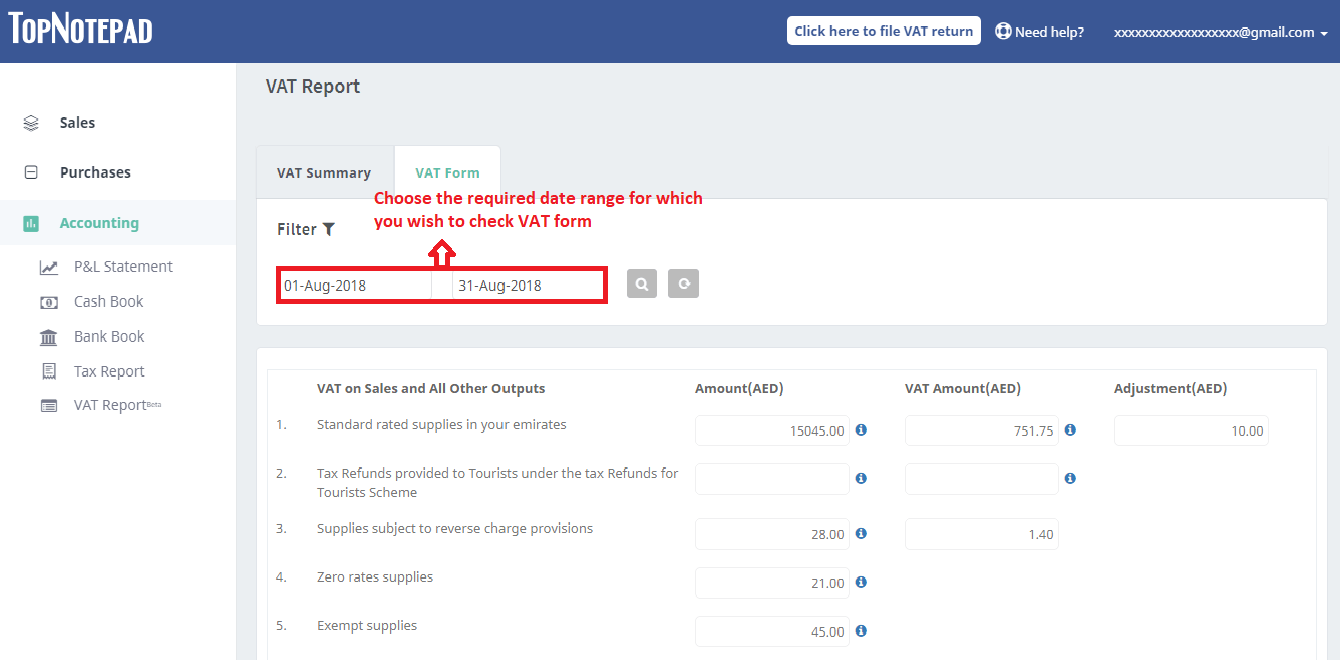

Step 2: Select the VAT period for which you wish to file VAT returns. It could be a month or a quarter. Please note, by default the form in this VAT accounting software will show data for previous month.

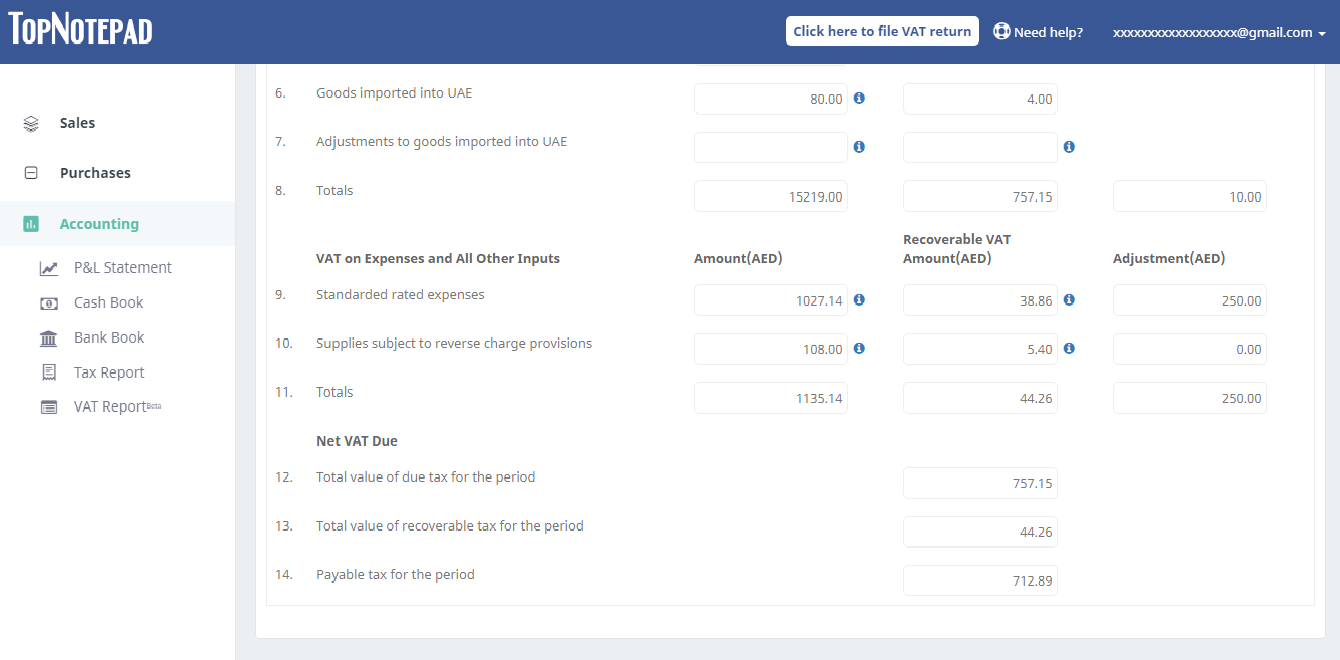

The best part this feature is that the VAT Form is auto populated based on all the VAT invoice you created and expenses/purchases you logged. Also, the form’s layout is exactly same as it appears on the FTA portal, so that there’s no room for any confusion.

Just copy and paste the data from TopNotepad to the VAT form on FTA portal to file returns.

Go back to the list of all tutorials

Step 1: Go to the accounting module by clicking on the “Accounting” option available on the left hand navigation. Now, click on VAT report and select VAT form as shown in the screenshot below.

The best part this feature is that the VAT Form is auto populated based on all the VAT invoice you created and expenses/purchases you logged. Also, the form’s layout is exactly same as it appears on the FTA portal, so that there’s no room for any confusion.

Just copy and paste the data from TopNotepad to the VAT form on FTA portal to file returns.

Go back to the list of all tutorials