NZ Invoice – Here is what they must include

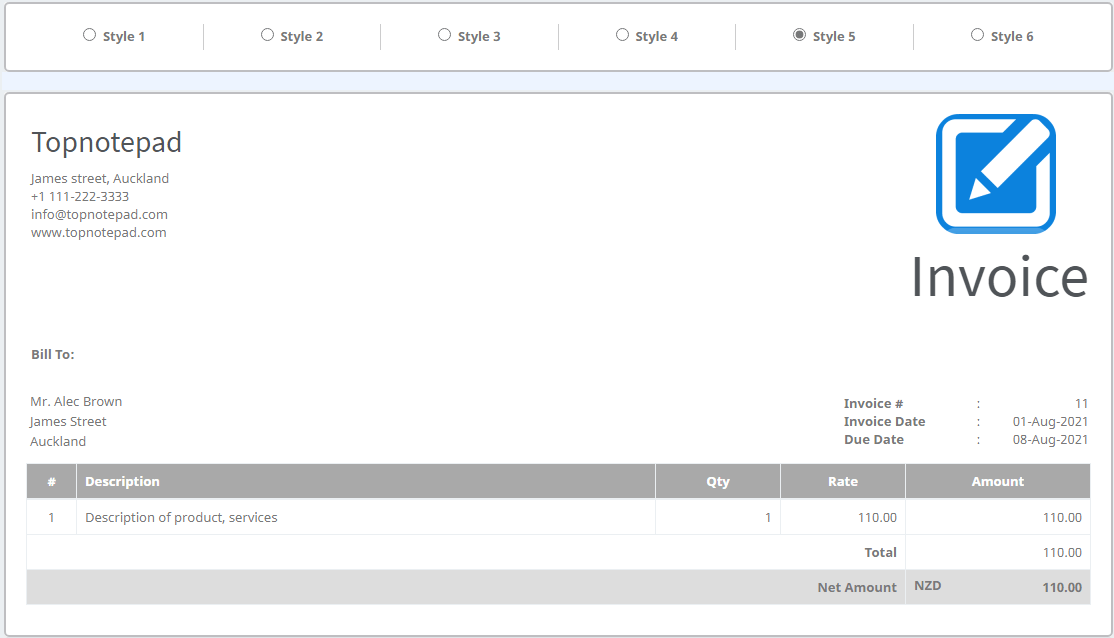

Create a IRD compliant invoice by including the information listed here

Invoicing is an important document for not only getting paid but it is also an evidence of business transaction that it is enforceable by law. It is important to understand what needs to be on an invoice NZ businesses use for collecting payments and claiming GST on goods and services.

• GST Number, if you are registered

• A unique invoice number

• Date of the invoice

• Details of customer you’re invoicing i.e., name and contact information

• Detailed description of product or service that you’re charging for

• Price being charged for each unit of goods or services and total units sold

• GST Amount, if applicable

• Total amount due

As per New Zealand invoice law businesses must issue a tax invoice if the business is GST registered and must get a tax invoice to claim GST on goods or services costing over $50 which the business buys as part of your taxable activity.

Please note, a New Zealand Business Number (NZBN) is required if you have a business with a turnover of NZD $ 60,000 or above. This number needs to be on the invoice, preferably mentioned in the header section. You can get NZBN from the Inland Revenue department.

Businesses can also charge late payment fee in case client delays the payment, however late payment can be charged only when it is agreed and is mentioned on the invoice. So be sure to include clear terms and conditions on your NZ invoice. In general you must include payment terms, return policy and any other disclaimers on your invoice.

NZ Invoice – Here is what they must include

• Name of your business, address and contact information• GST Number, if you are registered

• A unique invoice number

• Date of the invoice

• Details of customer you’re invoicing i.e., name and contact information

• Detailed description of product or service that you’re charging for

• Price being charged for each unit of goods or services and total units sold

• GST Amount, if applicable

• Total amount due

As per New Zealand invoice law businesses must issue a tax invoice if the business is GST registered and must get a tax invoice to claim GST on goods or services costing over $50 which the business buys as part of your taxable activity.

Please note, a New Zealand Business Number (NZBN) is required if you have a business with a turnover of NZD $ 60,000 or above. This number needs to be on the invoice, preferably mentioned in the header section. You can get NZBN from the Inland Revenue department.

Businesses can also charge late payment fee in case client delays the payment, however late payment can be charged only when it is agreed and is mentioned on the invoice. So be sure to include clear terms and conditions on your NZ invoice. In general you must include payment terms, return policy and any other disclaimers on your invoice.