Quebec invoice template

Revenue Québec compliant simple online invoice template

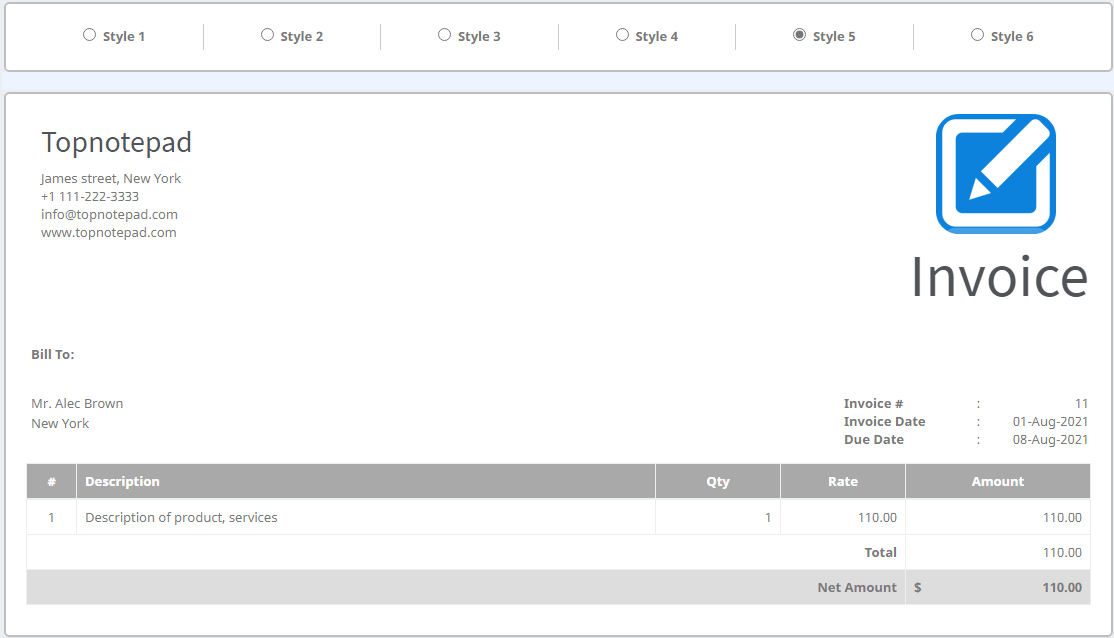

Here is Quebec invoice template for creating QST complaint invoices. All you need to do is follow the templates work flow to create an invoice compliant to the Quebec law.

Please note the Quebec sales tax, also referred as QST is currently 9.97% on the sales or lease price of products and services. QST is applicable along with the federal sales tax i.e., GST which is 5%.

Our flexible Quebec invoice template lets you apply both QST and GST on your invoice and clearly show the federal tax and Quebec tax separately both in percentage and absolute dollar.

You can download the PDF copy of the invoice or export it in excel or word. In case you want to create your own Quebec invoice template you can do so. Please create following sections in your template:

- Seller details (your business name and address)

- Tax identification number of your business

- A unique invoice number to identify the transaction

- The date on which invoice is issued

- Buyers details (Name and address)

- Description of the goods sold or services rendered

- Unit rate of each product or service and number of units sold

- Item level total amount

- Overall invoice total and net amount payable including taxes (QST and GST)

- Applicable terms and conditions

Once you create the section and take a look at our Quebec sample data on this page to verify the Quebec invoice template you created covers all the element required for creating a Quebec invoice.

Please note the Quebec sales tax, also referred as QST is currently 9.97% on the sales or lease price of products and services. QST is applicable along with the federal sales tax i.e., GST which is 5%.

Our flexible Quebec invoice template lets you apply both QST and GST on your invoice and clearly show the federal tax and Quebec tax separately both in percentage and absolute dollar.

You can download the PDF copy of the invoice or export it in excel or word. In case you want to create your own Quebec invoice template you can do so. Please create following sections in your template:

- Seller details (your business name and address)

- Tax identification number of your business

- A unique invoice number to identify the transaction

- The date on which invoice is issued

- Buyers details (Name and address)

- Description of the goods sold or services rendered

- Unit rate of each product or service and number of units sold

- Item level total amount

- Overall invoice total and net amount payable including taxes (QST and GST)

- Applicable terms and conditions

Once you create the section and take a look at our Quebec sample data on this page to verify the Quebec invoice template you created covers all the element required for creating a Quebec invoice.