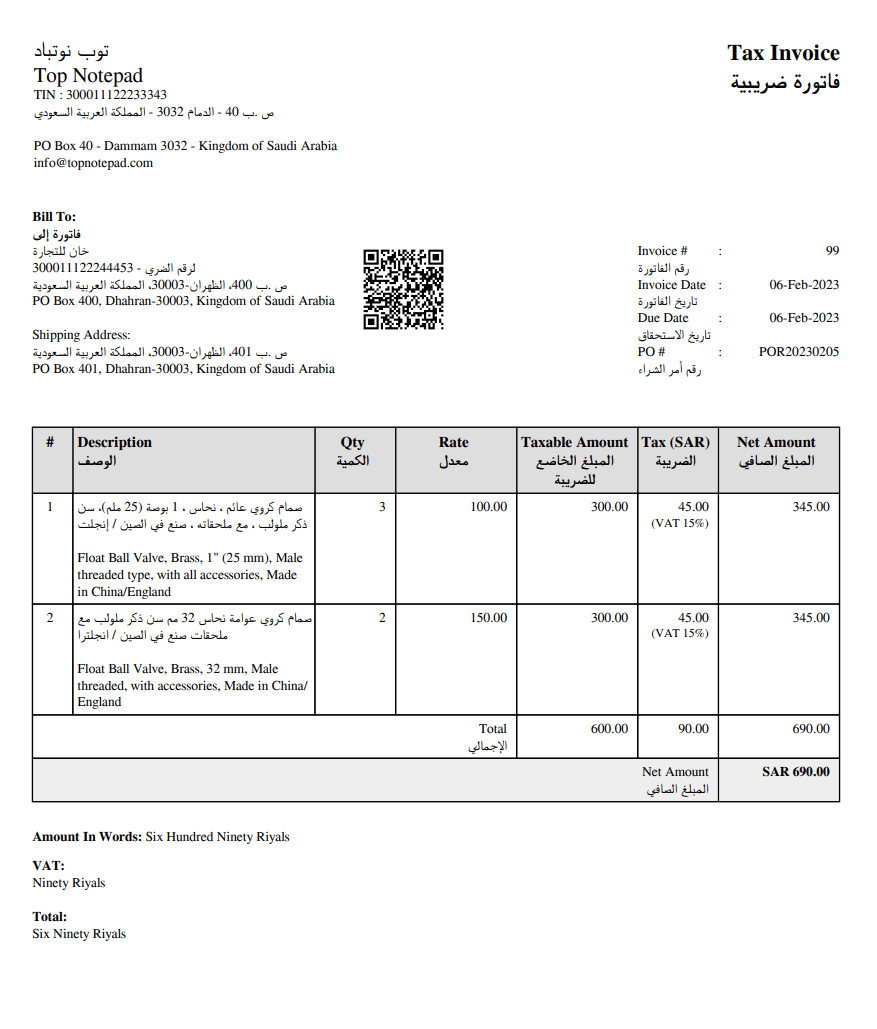

Saudi GAZT Approved Free VAT Accounting Software

E-Invoicing and accounting software to stay VAT compliant.

برنامج جاهز لضريبة القيمة المضافة

Here is a simple yet powerful Saudi VAT ready software that lets you create VAT compliant invoices, track purchase bills and automatically generates VAT form, an all-in-one Saudi VAT ready software.

Tracking VAT liability on regular basis without support of a software tool is an overwhelming job. Precise VAT tracking requires consolidation and categorization of sales and purchase. A Saudi VAT ready software would have features to consolidated sales & supplies. They must be further categorized into the following:

- Sales made at standard rated VAT

- Sales made at zero rated VAT

- Supplies that are exempted from VAT

- Export sales made to the GCC member states

- Export sales made outside GCC member states

Similarly, purchases & expenses must be further grouped by a VAT ready software into the following:

- All purchases & expenses that attracted standard VAT rate

- Purchases that are zero rated

- Exempted purchase

- Imports that were customs paid

- Imports under reverse charge

Any software that is VAT ready for Saudi Arabia should also be able to create a VAT form automatically. The VAT form designed by the General Authority for Zakat and Tax (GAZT) requires consolidated information of VAT collected on sales i.e., output VAT and VAT paid on purchases that is input VAT. The difference of output and input VAT gives the new VAT liability.

There are quite a few Saudi VAT ready software services in the market but very few are exhaustive. Most of the software are very basic and do not have features to track import VAT and VAT under reverse charge.

Our recommendation to small businesses is choose a software that is truly a Saudi VAT ready invoicing and accounting software. The software should be easy to use and affordable. The user of such software should need no support from a VAT consultant and should be able to file VAT returns on own.

Tracking VAT liability on regular basis without support of a software tool is an overwhelming job. Precise VAT tracking requires consolidation and categorization of sales and purchase. A Saudi VAT ready software would have features to consolidated sales & supplies. They must be further categorized into the following:

- Sales made at standard rated VAT

- Sales made at zero rated VAT

- Supplies that are exempted from VAT

- Export sales made to the GCC member states

- Export sales made outside GCC member states

Similarly, purchases & expenses must be further grouped by a VAT ready software into the following:

- All purchases & expenses that attracted standard VAT rate

- Purchases that are zero rated

- Exempted purchase

- Imports that were customs paid

- Imports under reverse charge

Any software that is VAT ready for Saudi Arabia should also be able to create a VAT form automatically. The VAT form designed by the General Authority for Zakat and Tax (GAZT) requires consolidated information of VAT collected on sales i.e., output VAT and VAT paid on purchases that is input VAT. The difference of output and input VAT gives the new VAT liability.

There are quite a few Saudi VAT ready software services in the market but very few are exhaustive. Most of the software are very basic and do not have features to track import VAT and VAT under reverse charge.

Our recommendation to small businesses is choose a software that is truly a Saudi VAT ready invoicing and accounting software. The software should be easy to use and affordable. The user of such software should need no support from a VAT consultant and should be able to file VAT returns on own.